In 2023, the Nebraska State Legislature passed The Opportunity Scholarships Act (LB753), which is a scholarship tax credit program.

In 2023, the Nebraska State Legislature passed The Opportunity Scholarships Act (LB753), which is a scholarship tax credit program.

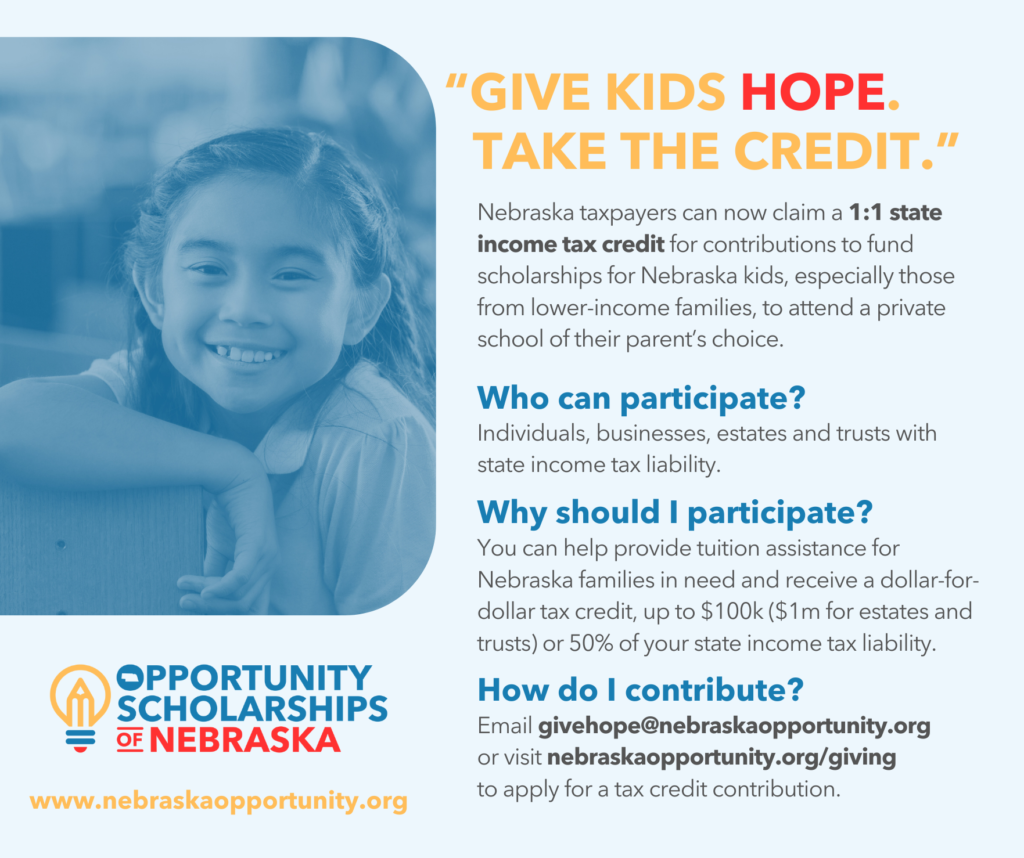

Taxpayers in Nebraska, whether individuals, businesses, estates, and trusts with state income tax liability, can claim a 1:1 tax credit for contributions to fund scholarships. The official Scholarship Granting Organization (SGO) for Nebraska District Lutheran Church—Missouri Synod schools is called Opportunity Scholarships of Nebraska. This state-approved scholarship granting organization will use those dollars to provide scholarships to eligible students.

The Opportunity Scholarships Act gives priority to children from the lowest-income families first, along with the qualifiers above, giving final priority to families making less than 300% of the federal Free and Reduced Lunch rate.

Bob Ziegler, Nebraska District executive for education and youth, explains, “We believe this is a matter of wise stewardship (Mark 12:17) since ‘Caesar’ (the Nebraska government) is saying that 50% of what you owe in taxes can be given to help children attend a faith-based school on needs-based scholarships instead of paying the government.” We encourage you to begin participating by utilizing these tax credits as soon as possible. through Opportunity Scholarships of Nebraska.

How to participate

To learn more about a scholarship for your child, visit THIS PAGE.

Nebraska taxpayers who want to support students in need of financial assistant to attend a school that works best for them are now offered a tax credit for contributions to Opportunity Scholarships of Nebraska (OSN)! Both individual and corporate taxpayers are eligible to claim a dollar-for-dollar tax credit contribution, up to 50% or $100,000, of their state income tax liability. To designate your tax dollars for these scholarships, visit THIS PAGE.

Share this information with your congregation and school family

Please consider sharing this information in your bulletins, newsletters, and social media:

- Image about making donations

- Image about applying for scholarships

- Image with QR code to learn more

- Opportunity Scholarships of Nebraska (official LCMS Scholarship Granting Organization)

- Google Drive resources folder